Nowadays digital transformation is key in any type of business. The 40% of Spanish companies will not exist in its current form in the next few [...]

Read More »In the dynamic financial world, optimizing the profitability of available assets is essential to the success of any entity. credit. Gamco, with its innovative solutions in Artificial Intelligenceaddressed this challenge by developing an early warning system for credit asset defaults.

This case study article explores how Gamco implemented early warning of defaults on credit assets in the environment of Bankia67 billion, achieving exceptional results in a short period of time.

Bankia's and Gamco's main objective was to establish a proactive approach to predict defaults on customers with assets and mitigate their impact on accounts of Bankia.

Recognizing that anticipation is essential to reduce the financial consequences, the following were proposed develop an early warning and strategy optimization system to mitigate the impacts of non-payments: decrease provisions for loan defaults.

The early warning system was to reduce the cost of risk while tailoring the product offering and pricing to each customer.

The Gamco's solution was based on an analysis and exploitation of data provided by Bankia.. Using information on the movements and positions of assets and liabilities of customers, their credit history and financial products contracted, specific predictive models of default were developed for Bankia customers, and optimized according to the actions defined by the risk management department.The company's financial services are based on the following criteria, for example: reduction or elimination of customer financing lines, requirements for the signing of new loans to customers, pricing of products according to customer risk or refinancing.

Gamco developed customized models for predicting unpaid of customers adapted to Bankia's risk management strategy. These models were trained with historical data, allowing early detection of defaults, the probability of occurrence and the impact on provisions if they occurred.

The advance predictions ranged from 60 to 180 days. The objective of each model was also adjusted to the needs of each group or user within the credit management department. For example, detection of customer incidences before generating cost to the entity (non-payments of the quota of very few days: between 1 and 7 days), more than 30 days of non-payment, entry into special surveillance (stage 2 according to IFRS 9) and entry into default.

By identifying potential defaults in advance, Gamco allowed Bankia to optimize preventive actions before defaults turned into major problems. This involved optimizing strategies to reduce risks and minimize financial consequences.

Gamco's efforts have culminated in notable and quantifiable achievements, which are presented below:

The implemented solution achieved an astounding predictive default detection rate, ranging from 77% to 83%. This allowed Bankia to anticipate and address default risks with a high degree of accuracy and forecast stability.

The ability of models created by machine learning to dynamically adjust to new realities was evident at the time of COVID. In March 2019, while confinement was declared in Spain, the classic scoring models used by the banking industry were no longer useful. Gamco's predictive models were able to adjust to the new reality based on data from March, April, and successive months during the pandemic.

For example: the drop in the forecasting rate in March and April 2019, due to the use of forecasts made in January (for models with a 60-day non-payment lead time) prior to the pandemic, was automatically recovered in May and June 2019, thanks in large part, to new data collected during March and April. This empirical demonstration of AI's ability to learn from newly known data was corroborated in the following months for models with prediction horizons of 90 days, 120 days, up to 180 days.

In just one year, Gamco generated a return on investment (ROI) that exceeded expectations.. The implementation of the solution not only helped to reduce the risks of non-payment, but also generated significant financial benefits: by reduce provisions for loan defaults by hundreds of millions of euros every year.

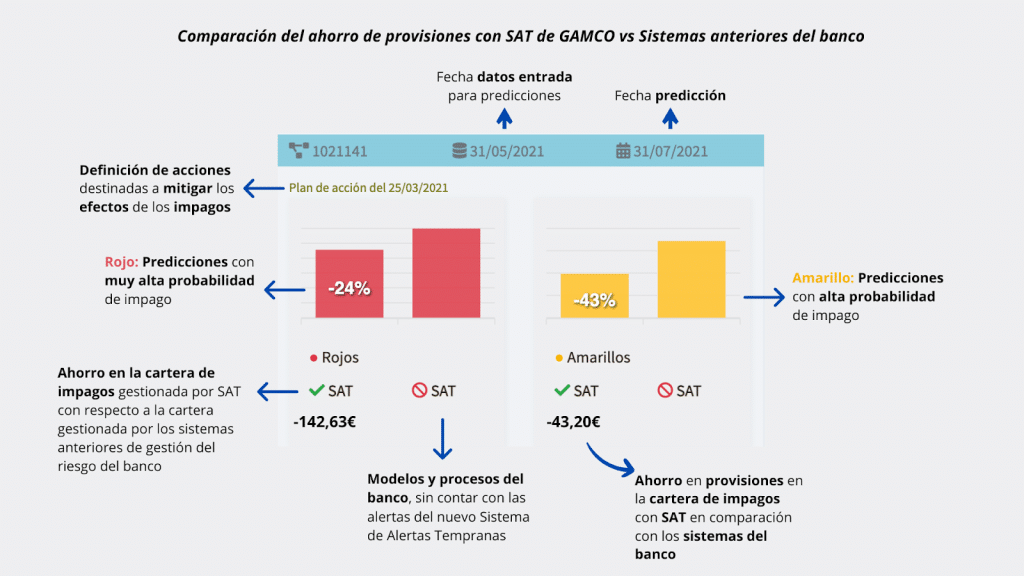

This ROI was verified by comparing portfolios managed with the early warning system based on GAMCO's solution and portfolios managed with the bank's models and procedures.

This chart shows how a data set as of May 31, 2021 was used to make predictions for July 31, 2021. Once that date was reached, these predictions were verified and it was possible to conclude that the model developed by Gamco performed much better than the bank's own internal systems. The differences were remarkable: Gamco's solution was able to reduce loan loss provisions by between 24% and 43% compared to the bank's systems. In economic terms, this translates into an average savings in provisions per customer of between €43.20 and €142.63.

It is important to highlight that the solution is not only predictive models to predict defaults, but also plays an important role in the definition of actions to mitigate risks. These actions are defined in the active action plans, for example, in the figure below had been previously defined in the action plan of March 25, 2021 in which mitigating actions are contemplated for processes such as the admission and pre-concession of loans.

These results highlight not only the accuracy of the models and mitigation actions, but also their ability to deliver rapid and substantial returns by more effectively identifying risky situations for the bank.

Gamco's solution was integrated with the bank's systems, making all operations fully automated.The system is designed to provide a complete solution for all your business needs, from updating the bank's data, evaluating customers through predictive models, transmitting default alerts, and monitoring actions and KPIs.

Also for the users of the risk management department (analysts, computer scientists and risk model specialists), the following is also deployed complete web application where you can monitor the entire system, configure the different parameters and download data and graphs. developed for the scorecards.

In addition, it is a fast and seamless integration, ensuring rapid adoption without interruption in existing systems.

This Gamco case study highlights how a company can Innovative vision and a proactive approach can transform risk management in the credit sector. By implementing an early warning system based on customized predictive models, Bankia was able to not only identify risks effectively, but also maximize its ROI in a surprisingly short period of time.

This experience underscores the importance of anticipation and adaptability in a constantly changing financial environment.

The early default detection solution developed by Gamco has proven to be an exceptional tool for optimizing risk management in the financial sector. If you would like to learn more about how this solution can strengthen your operations and improve the profitability of your credit assets, we invite you to explore our leading fraud detection and prevention software.

Our advanced technology is designed to empower your financial institution with a competitive advantage, anticipating and proactively addressing challenges in an ever-changing environment. Together, we can chart a path to a more secure and profitable financial future.

In addition, through our technology-based solution, we are able to ARMWe provide a comprehensive set of services covering the management, monitoring and recovery of risk portfolios. These strategies are designed to anticipate potential payment problems, optimize risk management and minimize associated costs in the financial and corporate sectors.

▶ Get more information on our page dedicated to the. fraud detection and prevention.

Nowadays digital transformation is key in any type of business. The 40% of Spanish companies will not exist in its current form in the next few [...]

Read More »Hoy, 3 de octubre, hemos estado en los prestigiosos "Premios SCALEUPS B2B organizada por la Fundación Empresa y Sociedad, para hablaros de la Medici� [...]

Read More »Machine learning is a branch of artificial intelligence (AI) that is based on making a system capable of learning from the information it receives.

Read More »The use of Artificial Intelligence in business is becoming more and more common and necessary for the optimization and evolution of processes. In one of our [...]

Read More »