Credit scoring is a system used to rate credits and thus try to automate the decision making process at the time of purchasing a loan, and to [...]

Read More »GAMCO's forecasts point to an increase of at least 10% in the percentage of "non-performing loans" to individuals over the next year.

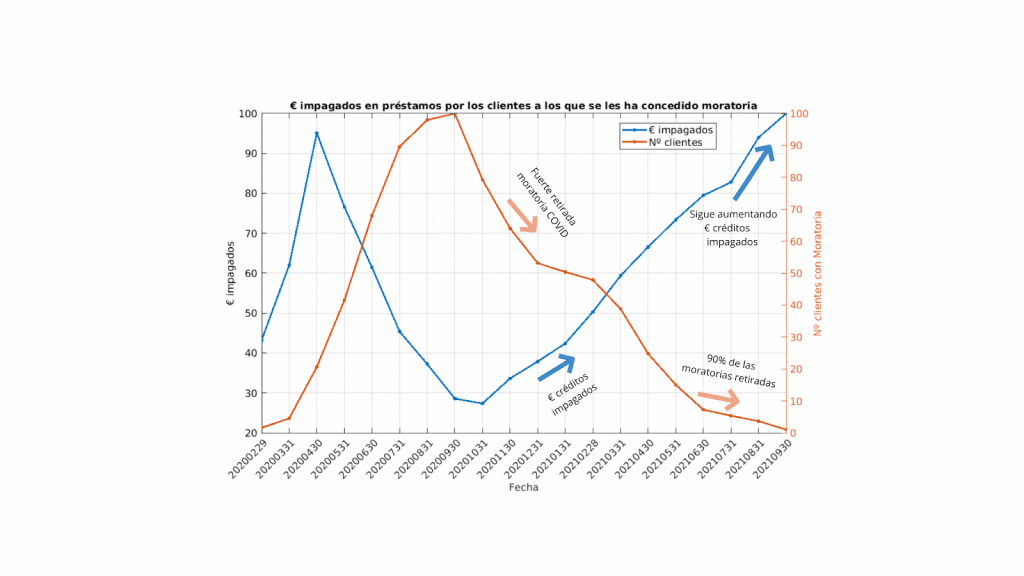

This is the result of an analysis based on big data that offers conclusions about the present and near future in the financial market by analyzing mainly two indicators: on the one hand, the relationship between the amount of euros of unpaid credits and the number of clients with COVID moratoriums and, on the other hand, the volume of defaults.

Looking back, there were fears from the early stages of the pandemic that loan defaults might increase. At that time, extraordinary moratorium measures and COVID loans seem to have cushioned the increase in loan defaults. delinquent loans.

However, the subsequent withdrawal of extraordinary actions due to the pandemic is causing an increase in the number of defaults, as it is not allowing a large number of companies and individuals to meet the payments of the installments of the credits given.

This will drastically affect the costs caused by defaults on loans, both consumer and mortgage. In fact, the amount of money defaulted on mortgages has increased by more than 12% over last year.

The data analyzed by GAMCO with big data reflect increased risk in the financial sector: lending is tightening and this is affecting the size of the loan portfolio, which has shrunk by an average of 15%.

Predictive models are tools that can help nip the problem in the bud, warning of potential defaults before they occur, opening up the range of possibilities in the measures to be taken. And this can be crucial for SMEs.

Faced with this scenario, GAMCO has developed the ARM SaaS solution, which allows SMEs to predict which customers are likely to default on their payments. 90 days in advance, thus helping to maintain a healthy client portfolio.

For SMEs, ARM SaaS is a convenient system to implement and use, as it does not require integration with any of their systems and, in addition, it gathers and clarifies the company's financial situation, thus facilitating decision making.

Checking the effectiveness of ARM SaaS is also very easy, since it has a free version that provides access to an analysis of the invoicing situation, debts, severity of non-payments and expected impact of ARM, customer and non-payment details, reports and debt categorization.

Credit scoring is a system used to rate credits and thus try to automate the decision making process at the time of purchasing a loan, and to [...]

Read More »How is artificial intelligence helping us? Artificial intelligence (AI) has gone from being the stuff of science fiction movies to a [...]

Read More »The current scenario we are experiencing in Spain with the COVID-19 health crisis has led to many companies having to carry out ER [...]

Read More »When it comes to gaining new clients, everything is joy and satisfaction for being able to provide them with our service or sell them our product in the best way possible, and we [...]

Read More »